Summary

On September 2, 2020, the Centers for Medicare and Medicaid Services (CMS) released updates to the Inpatient Prospective Payment System (IPPS) for fiscal year (FY) 2021, including updates to Medicare payment policies and payment rates for most acute care hospitals. Of particular note is the agency’s move to a new market-based methodology for establishing relative weights for Medicare Severity Diagnosis Related Groups (MS-DRGs).

A CMS factsheet on the final rule is available here. Policies implemented in the final rule are effective October 1, 2020, unless otherwise noted.

Key Takeaways

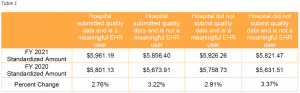

The final FY 2021 standardized amount for hospitals that successfully participate in the Hospital IQR Program and are meaningful EHR users is $5,961.19. This reflects an increase of 2.76% over the FY 2020 standardized amount ($5,801.13) for these hospitals. The update reflects a 2.4% market basket increase, plus other adjustments. Because of the Coronavirus (COVID-19) pandemic, the finalized market basket increase is lower than initially proposed. While CMS acknowledged the pandemic’s economic impact, the agency stated that it is critical to use the most recent economic forecasts available, as economic trends remain uncertain. Additionally, CMS will not apply a multifactor productivity adjustment for FY 2021 because CMS is not permitted to make a positive productivity adjustment and the calculated multifactor productivity adjustment was +0.1 percentage point.

The standardized amount varies based on an individual hospital’s participation in the Hospital IQR Program and meaningful use of EHR. Hospitals that fail to submit quality data are subject to a -0.75% adjustment, and hospitals that fail to use HER meaningfully are subject to a -2.25% adjustment.

Final FY 2021 standardized amounts are shown in Table 1. Amounts shown are the sum of the labor-related and non-labor-related shares without adjustment for geographic factors.

Methodology Change for Calculating MS-DRG Relative Weights

Key Takeaway: CMS finalized a market-based MS-DRG relative weight methodology beginning in FY 2024 that will utilize market-based data collected from hospital cost reports.

CMS calculates payment for a specific case under the IPPS by multiplying an individual hospital’s geographically adjusted standardized amount per case by the relative weight for the MS-DRG to which the case is assigned. Each MS-DRG relative weight represents the average resources required to care for cases in that particular MS-DRG, relative to the average resources required to care for cases across all MS-DRGs. MS-DRG classifications and relative weights must be adjusted at least annually to account for changes in resource consumption.

Currently, DRG relative weights are calculated using a cost-based methodology that primarily utilizes hospital charges from MedPAR claims data and hospital cost report data from the Healthcare Cost Report Information System. In recent years CMS has sought to reduce the Medicare program’s reliance on hospital charge data, believing that charge-master (gross) rates may not reflect true market costs.

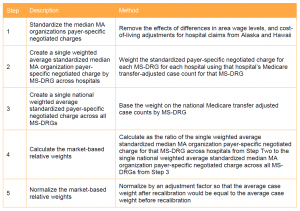

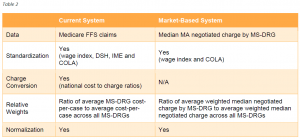

In the IPPS proposed rule, CMS presented a potential market-based methodology for estimating MS-DRG relative weights based on median payer-specific negotiated charge information collected on Medicare cost reports. CMS finalized that proposal in the final rule. The new methodology will be implemented beginning with FY 2024. Under the new methodology, MS-DRG relative weights will be based on the median payer-specific negotiated charge for each MS-DRG for payers that are Medicare Advantage (MA) organizations. The specific methodology includes the following steps:

CMS currently is not planning a transition to the market-based MS-DRG relative weight methodology, but said that it may consider a phased approach in future rulemaking. CMS expects that for some period of time it will estimate and publicly provide the MS-DRG relative weights calculated using the current cost-based estimation methodology for informational purposes after implementation of the new market-based methodology. Table 2 compares the current and market-based systems on key methodological elements.

CMS did not present an estimate of the policy’s economic impact, but stated that once it has access to the payer-specific negotiated charge information at the MS-DRG level, it will more precisely estimate the potential payment impact prior to implementation. CMS stated that it will apply a budget neutrality factor to ensure that the overall payment impact of any MS-DRG relative weight changes is budget neutral, as required by statute and consistent with current practice.

Market-Based Rate Data Collection

Key Takeaway: CMS will collect market-based rate information on the Medicare cost report beginning with cost reporting periods ending on or after January 1, 2021.

To effectuate the methodology change described above, CMS will require hospitals to report market-based payment rate information on their Medicare cost reports for cost reporting periods ending on or after January 1, 2021. CMS will require hospitals to report on the Medicare cost report the median payer-specific negotiated charge by MS-DRG that the hospital has negotiated with all of its MA payers. Hospitals with a fiscal year that runs April 1 through March 31 will be the first to report this data, whereas hospitals with a fiscal year that runs January 1 through December 31 will be the last. CMS did not finalize its proposal to require hospitals to report the median payer-specific negotiated charge by MS-DRG for all of its third-party payers.

CMS believes that because hospitals are already required to publicly report payer-specific negotiated charges in accordance with the Hospital Price Transparency Final Rule, the additional calculation and reporting of the median MA negotiated charge by MS-DRG will be less burdensome for hospitals. CMS will provide further instructions for reporting this market-based data in a forthcoming revision of a currently approved Information Collection Request, and may provide additional guidance as determined appropriate or necessary.

Expanded Alternative Pathway and Conditional Approval for Certain Antimicrobial Products

Key Takeaway: CMS finalized changes to the NTAP process to facilitate add-on payments for certain antimicrobial products, including by allowing conditional approval for products not FDA-authorized by July 1 of the fiscal year for which conditional approval is granted.

Under the NTAP program, CMS provides additional payment for new medical services or technologies in the inpatient hospital setting. Services and technologies defined as new that meet specific cost thresholds and demonstrate substantial clinical improvement over existing services or technologies qualify for an add-on payment under this program.

With the intent to support and improve beneficiary access to new technology, CMS finalized for FY 2021 several policies streamlining and facilitating access to add-on payments for certain antimicrobial products.

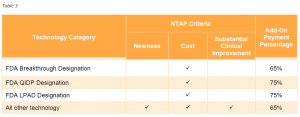

Currently, NTAP payments are equal to 65% of the estimated costs of the inpatient case in excess of the full diagnosis-related group payment, up to a maximum of 65% of the costs of the technology. For antimicrobial products approved for NTAP through the alternative pathway, the NTAP payment percentage is 75%. This payment percentage will apply to LPADs. Table 3 summarizes by pathway the criteria applicable for new technologies seeking NTAP as well as the applicable add-on payment percent.

NTAP Applications for FY 2021

In this final rule, CMS presented 22 NTAP applications for FY 2021, of which 16 were approved. Of the approved technologies, seven devices applied through the traditional pathway, and nine went through established alternative pathways (three devices with breakthrough status and six products designated as QIDP). For FY 2021, CMS also will continue add-on payments for 10 of the 18 technologies currently eligible (the remaining eight technologies no longer qualify as “new”).

Cost Criterion for NTAP Applications for FY 2022 and Beyond

In assessing whether a new technology qualifies for add-on payment, one criterion is whether the charges for the new technology meet or exceed certain threshold amounts. In recent years, CMS has evaluated this cost criterion using threshold amounts established in the prior year’s final rule. In this rule, for FY 2022 and beyond, CMS modified that policy in cases where CMS proposes to assign the technology to a proposed new MS-DRG. In such cases, CMS will use the proposed threshold amounts for the upcoming fiscal year for any proposed new MS-DRGs to evaluate whether the technology meets the cost criterion.

CMS made no changes to the other criteria (newness and substantial clinical improvement) considered when evaluating a new technology’s eligibility for add-on payments.

New MS-DRG for CAR-T Cell Therapy

Key Takeaway: CMS finalized new MS-DRG 018 (Chimeric Antigen Receptor (CAR) T-cell Immunotherapy).

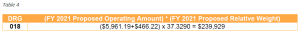

In response to multiple stakeholder requests for a new MS-DRG for procedures involving CAR T-cell immunotherapies (CAR-T), and given the additional claims data now available on these procedures, CMS finalized its proposal to create the MS-DRG 018 (Chimeric Antigen Receptor (CAR) T-cell Immunotherapy). Any cases reporting the existing CAR-T ICD-10-PCS procedure codes (XW033C3 or XW043C3) will be assigned to this MS-DRG. The FY 2021 relative weight for MS-DRG is 37.3290, which results in a national, unadjusted payment amount of $239,929 (Table 4).

As CMS finalizes additional procedure codes describing CAR-T, CMS will use its established process to assign these procedure codes to the most appropriate MS-DRG.

CMS discontinued the NTAPs for two CAR-T products, Yescarta and Kymriah.

Additionally, as CAR-T cases will no longer be assigned to MS-DRG 016, CMS finalized its proposal to revise the title for MS-DRG 016 from “Autologous Bone Marrow Transplant with CC/MCC or T-cell Immunotherapy” to “Autologous Bone Marrow Transplant with CC/MCC.”

MS-DRG Reclassification Request Submission Deadline

Key Takeaway: CMS changed the deadline for submitting MS-DRG reclassification requests to October 20 of each year.

When deciding to make modifications to the MS-DRGs, CMS considers whether the resource consumption and clinical characteristics of patients with a given set of conditions are significantly different than the remaining patients represented in the MS-DRG.

CMS changed the deadline to request changes to the MS-DRGs from November 1 to October 20 of each year to allow the agency additional time for the review and consideration of any proposed updates. Interested parties should submit any comments and suggestions for FY 2022 by October 20, 2020, via the CMS MS-DRG Classification Change Request Mailbox located at MSDRGClassificationChange@cms.hhs.gov.

Major Complication or Comorbidity (MCC) or Complication or Comorbidity (CC) Subgroups

Key Takeaway: CMS revised criteria for creating a subgroup under a base MS-DRG to the non-complication or comorbidity (NonCC) subgroup.

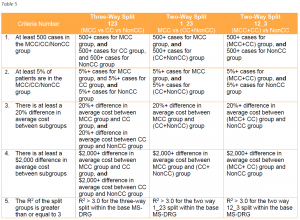

MS-DRGs contain base DRGs that are subdivided into one, two or three severity-of-illness levels. To determine if the creation of a new CC or MCC subgroup within a base MS-DRG is warranted, CMS evaluates the following criteria:

To warrant creation of a CC or MCC subgroup within a base MS-DRG, the subgroup must meet all five of the criteria above.

For FY 2021, CMS expanded the previously listed criteria to include the NonCC subgroup. CMS believes that applying these criteria to the NonCC subgroup will better reflect resource stratification and promote stability in the relative weights by avoiding low volume counts for the NonCC-level MS-DRGs.

Table 5 illustrates how the five criteria will be applied to each CC subgroup, including their application to the NonCC subgroup beginning with FY 2021 (the order in which the criteria are displayed has been revised for illustrative purposes).

CMS first evaluates whether the creation of a new CC subgroup within a base MS-DRG is warranted by determining if all the criteria are satisfied for a three way split. If the criteria fail, the next step is to determine if the criteria are satisfied for a two-way split. If the criteria for both of the two-way splits fail, then a split (or CC subgroup) is generally not warranted for that base MS-DRG.

In the Final Rule, CMS says that it does not intend to apply the expanded criteria to the NonCC subgroup retroactively in future rulemaking. The Agency did not address this issue in the proposed rule and retroactive application could have significant implications for existing MS-DRGs.

Low Wage Index Hospital Policy

Key Takeaway: CMS maintained the low wage index policy first implemented for FY 2020. Hospitals with wage index values below 0.8465 benefit in FY 2021.

For FY 2020, CMS implemented a policy that increased the wage index for hospitals with a wage index value below the 25th percentile. An affected hospital had its wage index value increased by half the difference between the otherwise applicable wage index value for that hospital and the 25th percentile wage index value across all hospitals. CMS achieved budget neutrality for this change by adjusting the standardized amount applied across all IPPS hospitals. The agency indicated that this policy will be effective for at least four years.

For FY 2021, CMS maintained this policy. The 25th percentile for FY 2021 is 0.8465. CMS will continue to achieve budget neutrality by adjusting the standardized amount.

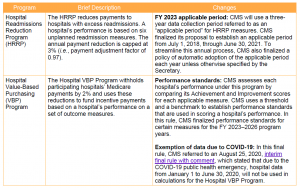

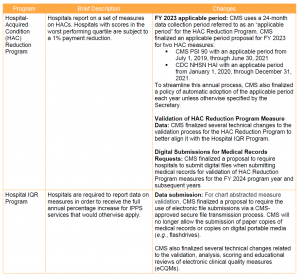

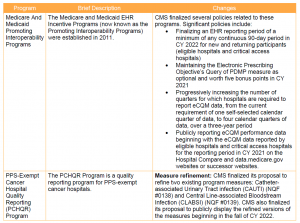

Key Takeaway: CMS implemented modest changes to IPPS quality programs for FY 2021.

In light of the ongoing public health emergency and its impact on hospitals, CMS finalized a limited set of new policies for the IPPS quality programs. These changes are summarized below.

For more information contact Sheila Madhani, Deborah Godes, Jessica Roth, Christine Song, Kelsey Haag or Benjamin Kerner.